Ever walked into a bank feeling like you have to prove you exist? If lenders have given you the cold shoulder on your business loan application, you are not the only one. Many of us struggle to get approved because credit history and cash flow play such a huge part in lender decisions.

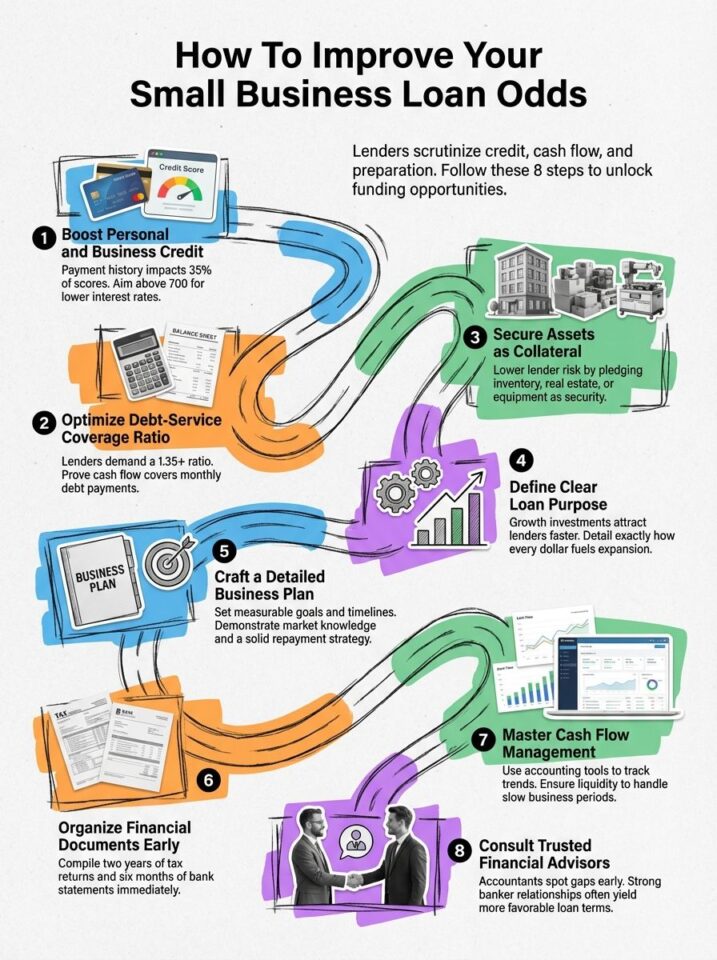

This guide on How to Improve Your Chances of Getting a Small Business Loan breaks down the real steps—like strengthening your credit score, organizing financial documents, and choosing the right financing options—that can actually move the needle.

I’m going to walk you through the exact steps I use, and I think you’ll be surprised at how manageable it can be. Find out what could open more doors for your next business move.

Key Takeaways

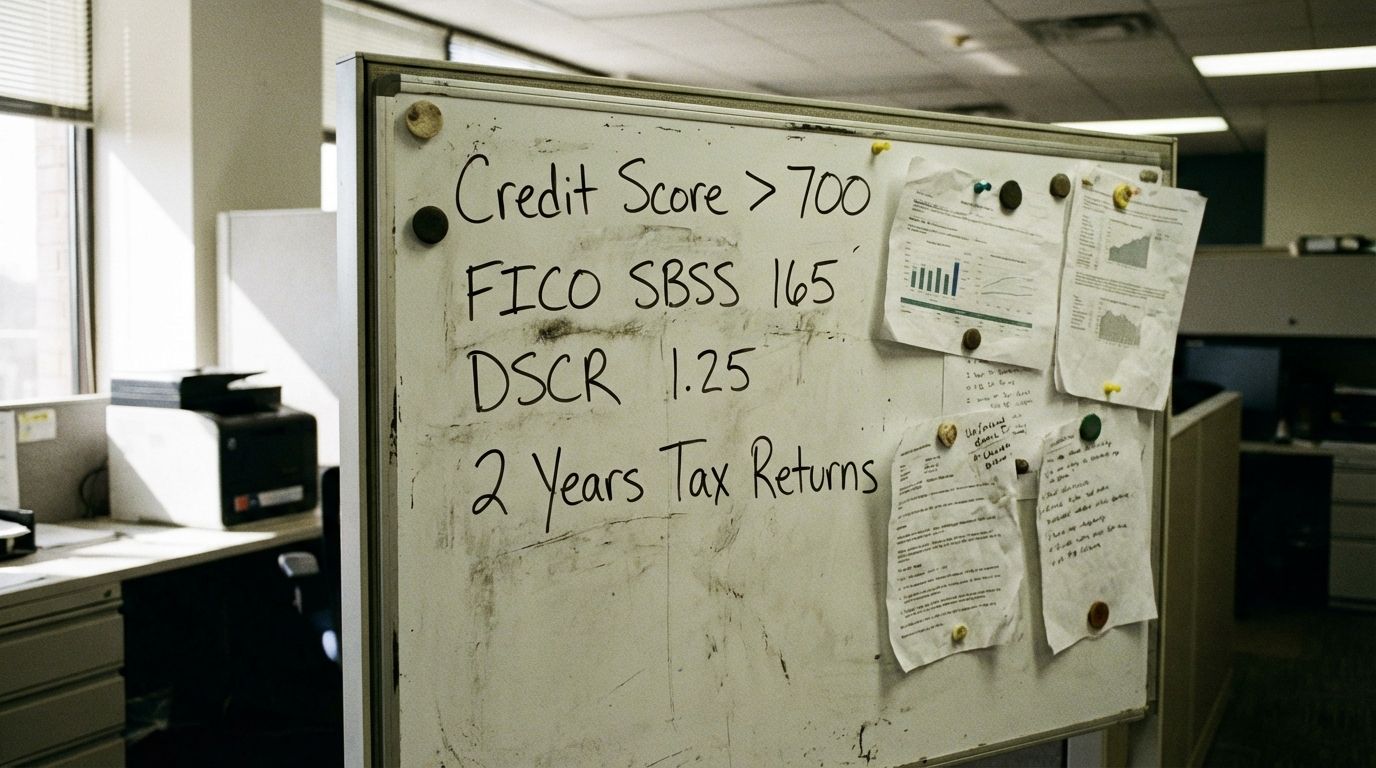

Credit scores matter more than ever: Lenders prefer applicants with strong credit profiles. A personal credit score above 700 increases your approval chances, while scores below 680 often lead to denials. For SBA loans, the magic number for your FICO SBSS (business score) is often 165.

Paperwork is proof: Banks require at least two years of business and personal tax returns, six months of bank statements, clear financial projections, and proof of collateral such as equipment or real estate.

Cash flow is king: The debt-service coverage ratio (DSCR) must be at least 1.25 to 1.35 for most lenders. If your DSCR is lower or you have a high debt-to-income ratio—like the example of 48% below—your application could be rejected.

Plans need precision: Business plans need specific goals—with measurable outcomes like “increase sales by 25% in twelve months”—and detailed loan usage explanations.

Options exist beyond banks: Alternatives such as crowdfunding platforms (like IFundWomen), SBA 7(a) loans, invoice financing, and merchant cash advances can offer funding when traditional banks say no.

Table of Contents

Key Factors That Affect Small Business Loan Approval

When I first decided to turn “Tidbits of Experience” from a hobby into a full-scale digital media brand, I walked into the bank smelling of spilt apple juice and unfounded confidence. My debt-to-income ratio was a bloated 48%, which the loan officer circled in yellow before showing me the door.

That sting pushed me to clean up both my business credit score and financial records. It turns out, I wasn’t alone. According to the 2025 Biz2Credit Women-Owned Business Study, while women-owned businesses saw an approval rate increase to 36%, we still often receive smaller loan amounts than men—averaging about $67,000 compared to $80,000.

Now, banks use hard numbers like your cash reserves, DSCR (debt-service coverage ratio), tax returns, and even how you separate your mortgage debt from everyday expenses. Here is how you can pull those levers so lenders know they are dealing with someone ready for real growth.

What role does my business and personal credit profile play?

Business and personal credit profiles weigh heavily on loan applications. Lenders review your business credit score and personal credit reports to judge how likely you are to repay a small business loan.

Payment history counts for 35 percent of your personal credit score, while debt owed makes up 30 percent. A score under 680 often leads to bank denials, while scores above 700 open many doors with lower interest rates.

For SBA loans specifically, lenders look at your FICO SBSS score. This score ranges from 0 to 300. As of 2025, many lenders set their minimum requirement at 165 for pre-screening. If you are sitting at 140, you might get flagged for a manual review, which takes longer and requires more paperwork.

Mortgage debts hit $16.01 trillion in the U.S. by 2021, impacting many women’s financial risk profile and eligibility for commercial real estate loans. Bureaus like TransUnion track every inquiry, payment delay, or unpaid balance on your accounts—including credit card bills—so tidying up those records is critical before applying for financing options such as Virginia small business loans.

A solid track record today means more money tomorrow—and fewer headaches.

How do lenders assess my capacity to repay the loan?

Strong credit profiles set the stage, but lenders also shine a spotlight on your capacity to repay. Cash flow stands out as their favorite metric for small business financing health.

Bankers pull out calculators and focus on your Debt Service Coverage Ratio (DSCR). This ratio is your net operating income divided by your annual debt payments.

Here is the breakdown lenders use:

- 1.00 DSCR: You are breaking even. Every dollar you earn goes to debt. This is risky.

- 1.25 DSCR: You have a 25% buffer. This is the minimum “sweet spot” for most banks in 2026.

- 1.35+ DSCR: You are a strong candidate. Banks love this number for approving new bank loans or SBA loans.

Lenders collect at least two years of tax returns, year-to-date financials, personal statements, and details about capital assets or cash reserves. Businesses buried in debt will find fewer options than those with strong revenue streams and healthy equity positions.

Why is collateral important for a loan?

Lenders view collateral as a safety net. If your business cannot repay, the lender can claim assets like inventory, real estate, or equipment to cover the loan.

Banks often shy away from applications without collateral, calling them too risky. This is why small businesses with fewer assets face steeper hurdles compared to large firms overflowing with stock and property.

Accounts receivable and cash also count as common types of collateral for business loans. Some options offer flexibility; merchant cash advances use future credit card sales instead of physical assets. Even government-backed SBA 7(a) loans usually want at least minimal backing by business property.

I once saw an entrepreneur get turned away because her chosen asset—a delivery van—already had a lien on it. Ensure your assets are free and clear before listing them.

How does the loan amount and its purpose impact approval?

Choosing the right loan amount can tip the scales. Banks look twice if you ask for too much or far too little. Roderick Wilson of Bank of America notes that working with a banker to set this number boosts your chances.

He suggests accounting for every expense, especially in fields like healthcare, where missing costs can trip you up fast. Lenders use your business budget to check if the line of credit fits what you need.

Explaining how you will spend each dollar matters even more than the size of your request. Funds aimed at investment and growth attract lenders quicker than money planned just to cover losses or refinance old debts.

| Loan Purpose | Lender Perception | Approval Odds |

|---|---|---|

| Buying Equipment | Asset-backed, clear ROI | High |

| Marketing Campaign | Speculative but growth-focused | Medium |

| Covering Payroll | Sign of cash flow distress | Low |

A clear plan for each borrowed dollar speaks louder than vague promises, said Roderick Wilson from Bank of America during his 2023 interview on smart small-business financing strategies.

How Can I Strengthen My Credit Profile?

Boosting your credit profile starts with checking your reports from agencies like Experian, fixing any errors, and paying bills on time. Want a better shot at business loaning? Keep reading.

How do I check and improve my personal credit score?

Checking your personal credit score is the first step to boosting your chances of loan approval. Good scores help women business owners get better rates from lenders and qualify for higher credit limits.

- Pull your credit report for free from Experian, Equifax, or TransUnion once per year through AnnualCreditReport.com. Review each detail to spot errors.

- Pay debts on time since even one missed payment may drop a FICO score by up to 100 points. Consistent on-time payments show strong financial stability.

- Keep credit card balances below 30% of the given limit. If your limit is $10,000, never let the balance sit above $3,000.

- Dispute mistakes you see with any credit reporting agencies. Inaccurate entries sometimes result from old loans or mixed files.

- Avoid opening new accounts too quickly because each hard inquiry can shave several points off a score.

- Use tools like Experian Boost. It lets you add on-time utility and streaming service payments to your file, which can give your score an instant lift.

- Set up alerts with major bureaus so you can monitor changes instantly and react fast if fraud occurs.

- Stick to a plan: sound budgeting helps you control spending and lets you pay off balances faster.

What steps build strong business credit?

Strong business credit helps women entrepreneurs get better loans, lower interest rates, and more flexibility. Lenders want to see responsible financial habits and organized paperwork.

- Apply for an Employer Identification Number (EIN) with the IRS. This keeps your personal details safe while showing lenders you run a real operation.

- Set up an LLC or another legal structure to separate your business from your personal finances.

- Open a dedicated business bank account right away. Mixing personal cash with company money is a major red flag for lenders.

- Request vendors to report positive payment history. Companies like Uline, Quill, and Grainger offer “Net-30” terms and reliably report your payments to bureaus like Dun & Bradstreet.

- Always keep the credit utilization rate at 30% or less on business credit cards.

- Obtain a D-U-N-S number from Dun & Bradstreet. Many creditors require it before offering trade terms.

- Check your company’s business credit reports often for errors on all major bureaus—not just one source.

- Pay every bill early. A “Paydex” score of 80 (which is great) often requires paying before the due date, not just on time.

- Create detailed expense reports each month to spot leaks in spending.

- Use small loans or vendor terms wisely to show you handle borrowed funds well.

How Do I Prepare a Detailed Business Plan?

Craft a business plan that covers your goals, money strategy, and how you plan to use those funds. Keep reading for real tips.

What should I include when defining business goals and strategies?

Clear business goals and bulletproof strategies point the way to a loan-ready plan. Every lender wants to see your roadmap before giving you access to their credit line or venture funds.

You can use modern AI tools like LivePlan or even ChatGPT to help draft the structure, but the data must be yours. Lenders want to see specific S.M.A.R.T. goals.

- Specific & Measurable: Instead of “grow sales,” write “increase online revenue by 20% in Q3 2026.”

- Strategic Tactics: Explain exactly how you will achieve these goals using targeted marketing tactics or partnerships with local U.S. citizens.

- Product Distinction: List the products or services at the heart of your business strategy and describe what sets them apart.

- Customer Clarity: Name your ideal customer group. Use market analysis data to show lenders you understand who needs your service.

- Resource Mapping: Map out key resources needed, like hiring two new employees or upgrading equipment.

- Financial Benchmarks: Include current success metrics such as monthly sales revenue or active users.

- Timelines: Set clear timelines that plot each major step.

- Risk Management: Detail how you will handle unexpected costs using cash flow projections.

- Unique Advantages: Highlight a patent filing or a history of positive reviews to show why your idea deserves funding from the U.S. Small Business Administration.

- Contingency Plans: Identify what you will do if things go sideways, such as pivoting to personal loans.

How do I clearly outline the loan’s intended use?

Spell out how the loan will spark business growth by focusing on investments like new inventory, equipment, or expansion. For example, explain that you want to use $50,000 to buy kitchen appliances for a catering startup or upgrade your point-of-sale system.

Banks and the U. S. Small Business Administration give more weight to loans that create jobs or open doors for growth instead of covering past losses. Add specifics with numbers and timelines—show that in six months after purchasing equipment with raised funds, your revenue should rise by 25 percent.

Back up these claims using clear data from your cash flow projections or sales history. Include details about how this investment connects directly to your business goals.

A note on reporting: While 2024 introduced strict Beneficial Ownership Information (BOI) reporting, a March 2025 interim rule from FinCEN effectively removed this requirement for many domestic U.S. companies. Check with your legal advisor, but this is one less hoop you likely need to jump through.

How Do I Organize My Financial Documents?

Gather your business tax forms and bank statements in labeled folders using QuickBooks or Wave to keep your loan application stress-free. Want more tips?

Which tax returns and bank statements do I need to gather?

Two years of business tax returns will need to land in your folder. Lenders usually ask for both your business and personal filings, so grab those 1040s and any corporate return like Form 1120 or 1065.

Six months of bank statements help show the real money flow, not just numbers on a page. Cash flow matters more than fairy tales here.

Bring your latest profit and loss statement plus a sharp balance sheet that lists assets, debts, and equity. If you have an “Aged Accounts Receivable” report, include that too—it proves customers owe you money that is coming in soon.

In my last loan application for a retail store expansion, the underwriter grilled me about a missing lease agreement. Toss all legal contracts into your stack as well.

How do I prepare cash flow statements and financial projections?

Gather every tax return and recent bank statement. List all the money your business receives from sales, loans, or investments in one column. Chart each outgoing payment—suppliers, payroll, rent—in another.

Use accounting software like QuickBooks Online or Xero to fast-track calculations. These tools can automatically generate a “Statement of Cash Flows,” which is different from a P&L.

Set up clear financial projections for at least the next year. Lenders in 2026 often ask for a 13-week cash flow forecast. This specific document shows you can pay your bills for the next quarter.

Link these projections to your business goals. Show how new funds will boost future income streams. Organized records help highlight a strong DSCR for lenders considering your application.

How Can I Manage My Cash Flow Effectively?

Building emergency funds acts as a safety net for those oh-no moments, like surprise repairs or late customer payments. Creating a solid financial plan helps you budget and spot cash flow gaps before they snowball.

Use simple tools to track every penny in and out. These help you see patterns quickly. Float is a great app that integrates with accounting software to visualize your cash runway.

Maintaining accurate records means you are never caught off guard by missing numbers. Spread your sales across several clients or products so one slow month does not send your business into panic mode.

Forecast income and expenses with free templates from the U.S. Small Business Administration, so liquidity stays strong even if storms hit. Need extra tips? Check out “Trouble Managing Cash Flow? Some Strategies to Stay in the Green” for real-life fixes shared by women who raised funds and boosted their credit scores under pressure.

How Do I Work With a Trusted Advisor or Lender?

Strong cash flow management sets the perfect stage to work with a trusted advisor or lender. Advisors like accountants can help you organize financial documents, review your loan application, and spot any gaps before submission.

Lenders may ask for past tax returns, personal bank statements, and clear cash flow projections. They also might want explanations for negative marks on your credit report. Share all financial information openly; hiding details slows things down.

Women who raise funds often get better results by building good relationships with bankers or local lenders right from the start. Look for a SCORE mentor—this is a free resource in the U.S. where retired executives help you prep for these exact meetings.

These connections matter. Lenders tend to offer more favorable terms when you communicate well and show you value their time. Think of working with an experienced guide as having a GPS for business loans: less guesswork, fewer wrong turns, faster approval times.

What Alternative Financing Options Can I Explore?

Crowdfunding lets women-owned businesses tap a crowd of small supporters for cash. Sites like Kickstarter, GoFundMe, and Indiegogo make it simple to create a pitch and reach backers worldwide.

Some business owners skip traditional banks altogether by using these platforms when their credit or collateral falls short.

Grant opportunities are also huge for us. Look specifically at:

- The Amber Grant: Awards $10,000 every month to a woman entrepreneur.

- IFundWomen: A crowdfunding platform that also offers coaching and grants.

- Cartier Women’s Initiative: For businesses driving social change.

SBA 7(a) loans often bring lower interest rates and lighter collateral rules from Uncle Sam’s team. Equipment financing helps you snag that needed espresso machine or delivery van quickly without draining your savings.

Invoice financing gets quick money using unpaid invoices as backing, while merchant cash advances use future sales as fuel for fast funds. Peer-to-peer lending sites connect borrowers with individual lenders who may offer more flexible terms, though sometimes at higher costs.

What Should I Know About the Loan Application Process?

Start by collecting key documents such as your business plan, tax returns, bank statements, and legal paperwork like licenses or leases. Lenders usually ask for these to check your credit score and verify your details.

Make sure the authorized signer is a U.S. citizen or permanent resident who’s at least 18 years old. Each lender can request extra items based on the financing product.

| Loan Type | Typical Approval Time |

|---|---|

| Traditional Bank Loan | 1 to 3 Months |

| SBA 7(a) Loan | 60 to 90 Days |

| Online Lender / Fintech | 24 to 48 Hours |

| Business Credit Card | Instant to 1 Week |

Shorter processes pop up with business credit cards. A friend of mine landed her first loan using detailed cash flow projections from QuickBooks linked to her Square account. She said the prep made all the difference when questions came flying back from Bank of America reps.

Fixed repayments through Square Loans come straight out of card sales so payments shift up or down with daily income—makes things less stressful during slow seasons.

How Will Small Business Loan Standards Evolve in 2026?

Lenders will likely put a spotlight on business resilience and flexibility in 2026. You might see digital platforms like Kabbage or Fundbox take center stage for both quick funding and smarter loan screening.

More banks, such as Bank of America, may start weighing business credit scores from sources like Dun & Bradstreet and even mix in extra data to check risk beyond the basics.

Expect technology-driven tools that track cash flow, including real-time reporting apps, to play a big part during reviews. The use of AI in underwriting means decisions are happening faster—sometimes in minutes—but it also means your data needs to be squeaky clean.

Many lenders will want proof you have different ways to fund your company and clients who don’t all fit one mold. Expanding where your revenue comes from can tip approval odds in your favor as standards evolve past old-school models.

People Also Ask

What steps can I take to boost my odds of getting a small business loan?

To make your application stand out, aim for a personal credit score above 680 and have your profit and loss statements ready to go. Lenders also want to see a Debt Service Coverage Ratio of at least 1.25, which simply proves your business generates enough cash to comfortably handle the monthly payments.

How important is my credit history when applying for a small business loan?

Your credit history is vital because most US lenders review your personal FICO score just as closely as your business revenue. A strong score can qualify you for lower-interest options like SBA loans, while a spotty history might limit you to more expensive short-term financing.

Does having collateral help me get approved for a small business loan?

Yes, pledging tangible assets like inventory, equipment, or real estate significantly increases your approval chances by reducing the financial risk for the bank.

Should I compare different lenders before choosing where to apply?

Absolutely, because the difference in Annual Percentage Rates between a traditional bank and an online lender can be massive. Shopping around ensures you avoid high fees and find a repayment schedule that supports your cash flow rather than straining it.

References

https://www.sba.gov/blog/five-factors-impact-your-business-credit (2018-05-23)

https://www.britecap.com/10-factors-that-impact-small-business-loan-approval/ (2025-07-24)

https://business.bankofamerica.com/en/resources/what-is-business-credit-and-how-do-i-build-it (2025-10-27)

https://business.bankofamerica.com/en/resources/how-to-write-effective-small-business-plan (2024-09-26)

https://www.nerdwallet.com/business/loans/learn/how-to-write-a-business-plan-for-a-loan

https://ccifund.org/prepare-for-your-loan-gather-tax-returns-and-financial-documents/