You know that feeling when you’re staring at a puzzle, and it seems like half the pieces are missing? That’s exactly what trying to buy a house as a single mom felt like for me at first. Between juggling the electric bill, groceries, and child support, finding extra cash for a down payment seemed impossible.

But here is the secret most people won’t tell you: you don’t have to do it alone. There are assistance programs designed specifically for single parents that can bridge the gap. I’m going to share the smart little tricks I used to stretch my savings, boost my credit score, and find resources like FHA loans that fit a single income.

Ready to see how homeownership is actually possible for us? Grab a coffee (or a glass of wine), and let’s walk through the steps together.

Key Takeaways

Track every dollar: Keep your debt-to-income ratio under 43% and use apps like YNAB or PocketGuard to catch hidden spending; even simple swaps like packing school lunches can save $150 a month.

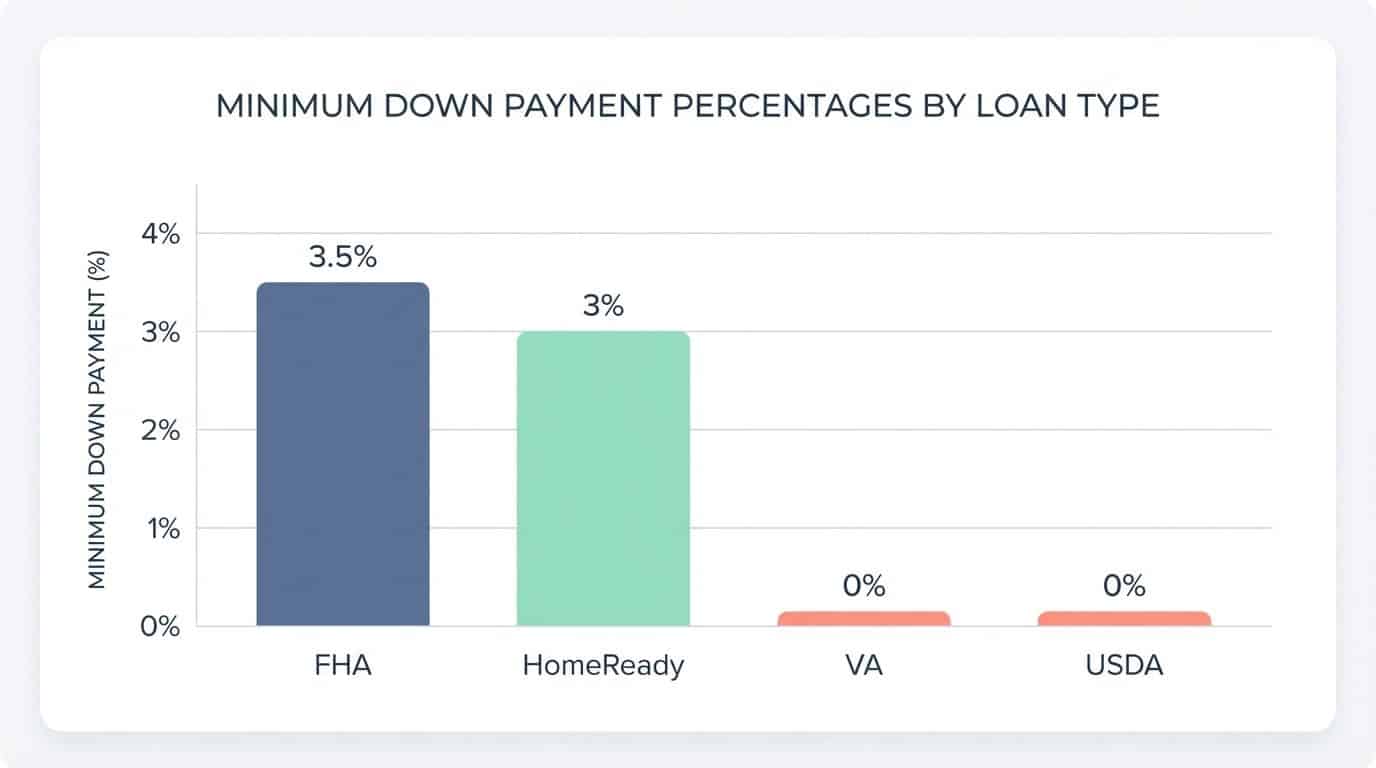

Leverage low-down-payment loans: FHA loans require just 3.5% down if your credit score is 580+; on a $250,000 home, that’s $8,750 upfront rather than the standard 20%.

Find free money: Look for down payment help from Minnesota Housing’s Start Up Program, the National Homebuyers Fund, or the Chenoa Fund, which can cover 3.5% to 5% of your costs.

Explore special loan types: VA loans offer zero down for veterans with no PMI, while USDA loans offer 100% financing for rural homes with income limits around $112,450 for smaller households in 2025.

Know the 2025 market: Mortgage rates averaged 6.79% in Q2, and FHA loan limits increased to a floor of $524,225, giving you more buying power even as prices rise.

Table of Contents

Assessing Your Financial Situation

Money talks, but my wallet usually just whispers. Before I even looked at a house listing, I had to get real about where every penny was going. I treated my bank statement like a map—I needed to know exactly where I stood before I could figure out where I was going.

![How To Afford A Mortgage As A Single Mom [2025 Guide] How To Afford A Mortgage As A Single Mom [2025 Guide]](https://www.tidbitsofexperience.com/wp-content/uploads/2025/12/infographic-How-To-Afford-A-Mortgage-As-A-Single-Mom-2025-Guide-415115-_0677.jpg)

How can I evaluate my income and expenses effectively?

I started with the basics. I didn’t just guess; I wrote it all down. It’s about treating each dollar like a trusted friend you don’t want to lose track of.

- Log every income source: Write down your salary, child support, alimony, and any regular cash gifts. If it hits your bank account, it counts.

- List all monthly expenses: This includes the big stuff like rent and car payments, but also the “invisible” stuff like streaming subscriptions, school field trip fees, and that morning latte.

- Separate needs from wants: Internet is likely a need for work and school; the premium cable package might be a want we can pause for a few months.

- Calculate your DTI: Divide your total monthly debt payments by your gross monthly income to find your debt-to-income ratio. Most lenders draw the line at 43%.

- Use a budgeting app: Tools like YNAB (You Need A Budget) or PocketGuard are lifesavers. They connect to your accounts and show you exactly how much “spendable” money you have left after bills.

- Check your eligibility: Use online mortgage calculators or chat with a find a mortgage broker to see what a bank thinks you can afford versus what you know you can afford.

- Create specific savings buckets: I opened separate savings accounts named “New Home Fund” and “Emergency Fund” so I wouldn’t accidentally spend my closing costs on car repairs.

- Audit your bank statements: Look at the last three months for spending patterns. Underwriters will look at these too, so you want to spot any overdrafts or odd large purchases first.

- Set banking alerts: I set my banking app to ding my phone if my balance drops below a certain amount. It stops me from overspending before it happens.

- Make small daily swaps: Packing snacks instead of hitting the vending machine saved me $150 last month alone. That is money that goes straight into the house fund.

Knowing these numbers gave me confidence. Instead of worrying about whether I could afford a home, I had a plan to make it happen.

What are the best ways to lower my debt-to-income (DTI) ratio?

Once I did the math, I realized my student loans were eating up too much of my monthly income. Lowering your DTI is one of the fastest ways to qualify for a better mortgage rate.

- Attack small debts: Paying off a small credit card balance completely eliminates that monthly minimum payment from your DTI calculation.

- Boost your income: It sounds obvious, but picking up a freelance gig or working a few hours of overtime increases the “income” side of the ratio, which lowers the percentage immediately.

- Refinance high-interest loans: I looked into refinancing my car loan to get a lower monthly payment. Even saving $50 a month helps your ratio.

- Consolidate debt: If you have three credit cards, combining them into one personal loan with a lower interest rate can lower your total monthly obligation.

- Stop using credit: In the months leading up to my application, I switched to debit only. New balances hurt your DTI right when you need it to be lowest.

- Avoid new credit inquiries: Do not apply for a new car or furniture store card before you close on your house. Lenders like Fannie Mae view new credit applications as a risk.

- Get expert advice: A financial advisor can help you see if using savings to pay off a specific debt is better than keeping the cash for a down payment.

- Consider a co-borrower: Adding a trusted family member to the loan increases the total household income, which can drastically lower the DTI ratio and open doors to FHA or Conventional loans.

Improving Your Credit Score

Improving my credit score felt a lot like cleaning out my garage—overwhelming at first, but incredibly satisfying once I started seeing results. Clearing up old errors and paying bills on time didn’t just boost my number; it qualified me for lower interest rates that save me thousands of dollars over the life of a loan.

How do I pay off existing debts to improve my credit?

Debt can feel like a heavy backpack you carry everywhere. I learned that you don’t have to pay it all off at once, but you do need a strategy to lighten the load.

- Fix past-due accounts immediately: If you have any missed payments, get current. Recent payment history is a huge chunk of your score.

- Target high-interest cards: I used the Debt Avalanche method, paying off cards with 24% APR first. This stops the interest from growing faster than you can pay it.

- Watch your utilization: Try to get your credit card balances under 30% of their limit. If your limit is $1,000, keep the balance under $300.

- Try the Snowball method: If you need a win, pay off the smallest debt first. Seeing one account hit $0 feels amazing and keeps you motivated.

- Use a balance transfer: I moved high-interest debt to a card with a 0% introductory APR. It gave me 12 months to pay down the principal without fighting interest charges.

- Talk to a pro: A certified credit counselor can help you set up a management plan if things feel out of control.

- Check your reports: I pulled my free reports and found an old medical bill that wasn’t mine. I disputed it, and my score jumped up when it was removed.

- Settle collections: Under newer scoring models like FICO 9, paid-off collection accounts hurt your score less than unpaid ones.

- Boost with utility bills: I used free tools like Experian Boost to get credit for paying my Netflix and electric bills on time. It’s an easy way to add positive history.

- Stay consistent: Every on-time payment is a deposit into your reputation. Lenders love consistency more than perfection.

Clearing these hurdles does more than just polish your credit report; it lowers your DTI and proves to lenders that you are ready for a mortgage. For a deeper look at what homeownership really costs, check out the true cost of homeownership.

Why is making consistent, on-time payments important?

Once the old debts were handled, I focused on never missing a due date. On-time payments are the single most important factor in your credit score, making up 35% of the total number.

If I miss even one payment, especially with a thinner credit file, my score could drop 50 to 100 points overnight. That could mean the difference between getting approved or getting denied.

Lenders want to see that I’m reliable. A steady payment history proves I can handle the responsibility of a mortgage. Plus, a score over 740 gets the best rates, while a score near 620 might cost me an extra 0.5% to 1% in interest. On a $300,000 home, that small difference costs over $100 extra every single month.

“Every dollar paid on time is a brick laid toward your future.”

This consistency opens the door to better FHA loans and keeps my options open if I ever want to refinance later.

Exploring Mortgage Options

I used to think you needed 20% down to buy a house. I was wrong. Programs like FHA, VA, and USDA are built for buyers who don’t have a mountain of cash sitting in the bank.

What are FHA loans and are they right for me?

FHA loans were my first stop because they are very friendly to single incomes. You can buy a home with a down payment as low as 3.5% if your credit score is 580 or higher. For a $250,000 house, that is just $8,750 upfront—much more achievable than the $50,000 you would need for a traditional 20% down payment.

Even if your score is between 500 and 579, you might still qualify with a 10% down payment. In 2025, the FHA loan limit for most areas increased to a floor of $524,225, so you can likely find a home that fits the criteria.

The catch is you will pay mortgage insurance premiums (MIP). There is an upfront fee of 1.75% added to your loan, plus a monthly fee. But since FHA allows a debt-to-income ratio up to 50% in some cases, it’s often the easiest door to open for single moms.

Who qualifies for VA loans?

If you have served in the military or are a surviving spouse, VA-backed home loans are hands-down the best option. I didn’t qualify personally, but my friend who served got into her house with zero down payment.

The Department of Veterans Affairs doesn’t require private mortgage insurance (PMI), which saves a huge chunk of cash every month. To apply, you need a Certificate of Eligibility (COE) based on your service time.

Lenders also cap the closing costs you can be charged, which keeps more money in your pocket. If you have a discharge that wasn’t honorable, you can even apply for a discharge upgrade to try and access these benefits.

What should I know about USDA loans?

USDA loans are a hidden gem for those of us willing to live a little further out from the city. They offer 100% financing—meaning no down payment—for homes in eligible rural and suburban areas.

The U.S. Department of Agriculture’s Rural Development program has strict income limits to ensure the help goes to those who need it. In 2025, the standard income limit for a 1-4 person household is roughly $112,450, though it can be higher in expensive areas.

Interest rates can be incredibly low, sometimes down to 1% with payment assistance subsidies. The property must be your primary residence, but if you find a home in a qualifying area, it’s one of the most affordable ways to buy.

How do conventional loans with low down payments work?

You don’t always have to go with a government program. Conventional loans have options like Fannie Mae’s HomeReady or Freddie Mac’s Home Possible that allow for just 3% down.

These programs are designed for buyers with income below 80% of the Area Median Income (AMI). You generally need a credit score of at least 620 to qualify.

| Loan Type | Min Down Payment | Min Credit Score | Key Benefit |

|---|---|---|---|

| FHA Loan | 3.5% | 580 | Flexible DTI rules |

| VA Loan | 0% | None (Lender 620+) | No PMI required |

| USDA Loan | 0% | 640 (Preferred) | 100% financing |

| HomeReady | 3% | 620 | Reduced PMI costs |

Unlike FHA, the private mortgage insurance (PMI) on these loans drops off once you build enough equity (usually 20%). Plus, you can use “boarder income” or a co-signer to help you qualify.

Leveraging Down Payment Assistance Programs

Did you know there are billions of dollars in grants available to help people buy homes? I found out that many state agencies and nonprofits offer funds specifically to cover your down payment and closing costs.

What state and local down payment assistance programs are available?

Finding these programs takes a little digging, but it pays off. State and local agencies want you to buy a home because it stabilizes neighborhoods.

- State Housing Finance Agencies: Almost every state has an HFA. For example, Minnesota Housing’s Start Up Program offers loans up to $18,000 to help with upfront costs.

- National Programs: Look into the Chenoa Fund. It’s a national program that provides up to 5% down payment assistance for FHA loans, and you don’t always have to be a first-time buyer.

- Forgivable Loans: Many cities offer loans that turn into grants. If you live in the house for 3 to 5 years, you never have to pay the money back.

- Closing Cost Grants: Some programs, like the National Homebuyers Fund, offer grants up to 5% of the loan amount that can be used for closing costs, which often surprise buyers at the last minute.

- Voucher Programs: If you currently use rental assistance, the Housing Choice Voucher Homeownership Program lets you use your voucher to pay a mortgage instead of rent. You typically need to be employed for a year and earn a minimum annual income (often around $14,500) to qualify.

- Neighborhood-Specific Grants: Some banks offer grants for buying in specific census tracts to encourage development. Ask your loan officer about “community lending” credits.

Don’t just assume you have to save every dollar yourself. Combining a 3.5% down payment FHA loan with a 3.5% down payment grant could mean you get into a house with almost zero money out of pocket.

How do grants and forgivable loans help with down payments?

Grants and forgivable loans were the only way I could make the math work. A grant from the National Homebuyers Fund can essentially wipe out the down payment requirement.

Forgivable loans act like a silent second mortgage. You don’t make monthly payments on them. Instead, a percentage of the loan is “forgiven” each year you stay in the home. After a set period—usually 3 to 10 years—the balance is zero.

With over 2,000 state and local programs available, there is likely one near you. Local nonprofits often combine these funds with closing cost aid, giving you a double layer of support. It transformed my “five-year savings plan” into a “buy now” reality.

Alternative Strategies for Affording a Mortgage

Sometimes you have to get creative. If the traditional route is blocked, look for a side door. I learned that bringing in a partner—on paper or in person—can change everything.

How can a co-signer or guarantor help me get a mortgage?

A co-signer is someone with stronger credit or higher income—like a parent or sibling—who signs the loan with you. Lenders look at your combined income, which can double your borrowing power.

However, it’s a big ask. If I miss a payment, it hurts their credit score too. It’s shared risk and trust. Some programs, like Freddie Mac’s Home Possible, allow for non-occupant co-borrowers, meaning my mom could co-sign without having to live in my spare room.

Just remember: a co-signer is responsible for the debt, but they don’t necessarily have rights to the property unless they are also on the title. Be clear about expectations before signing.

What are shared ownership or living arrangements, and how do they work?

I also looked into shared ownership, where I would buy a home with another single mom. We could split the mortgage, utilities, and childcare duties. It’s often called “mommune” living, and it’s gaining popularity.

Another option is buying a duplex. You live in one unit and rent out the other. The rental income counts toward your qualifying income for the loan. This is often called “house hacking.”

Local counselors helped me understand the legal agreements needed to make this work. It takes clear communication, but splitting a $2,000 mortgage is a lot easier than paying it alone.

How Will the Mortgage Landscape Change in 2025?

The market in 2025 has been a mixed bag, but there is good news for buyers like us. Refinancing rose by 63% in the first half of the year, which tells me people are finding ways to lower their payments.

The average 30-year mortgage rate hovered around 6.79% in Q2, with some experts predicting a dip to 6.4% or 6.5% by year-end. While that isn’t the 3% of the past, it’s stable enough to budget around.

Even better, agency delinquency rates dropped to 3.9%, which means fewer people are defaulting. Lenders like Fannie Mae and Freddie Mac see this stability and are more willing to approve loans for solid borrowers. Plus, with FHA loan limits rising to over $524,000, we have more room to shop even as home prices inch up.

Inflation is still a concern—expect prices to rise about 4% over the next few years. That makes buying now a smart hedge against future rent hikes. It’s not just about buying a house; it’s about locking in your housing costs for the next 30 years.

People Also Ask

How can a single mom afford a mortgage in 2025?

I found that FHA loans allow you to buy with just a 3.5% down payment and a credit score of 580, while USDA loans offer 0% down for homes in eligible rural areas. I successfully leveraged state-specific grants like the National Homebuyers Fund to cover my initial closing costs.

What steps should I take before applying for a mortgage as a single mom?

You should gather your W-2s and any divorce decrees to prove alimony or child support income clearly to lenders. I recommend getting a full pre-approval letter, rather than just a pre-qualification, to show sellers you are ready to buy.

Are there any financial tools that can help me manage my mortgage payments?

I personally rely on apps like You Need A Budget (YNAB) or Goodbudget because they help me track every dollar and spot hidden expenses instantly.

Can I get extra support if my income is limited as a single mom buying a house?

Yes, the Section 8 Homeownership Voucher program allows you to use your rental assistance vouchers toward mortgage payments instead. Additionally, Mortgage Credit Certificates (MCC) can provide a tax credit that frees up more of your monthly income for the loan.

References

https://lbcmortgage.com/buy-home-single-parent/

https://smartasset.com/financial-advisor/how-to-lower-your-debt-to-income-ratio

https://www.experian.com/blogs/ask-experian/how-to-reduce-dti-before-applying-for-loan/ (2025-11-13)

https://www.experian.com/blogs/ask-experian/what-debt-to-pay-off-first-to-raise-credit-score/ (2025-01-16)

https://www.bankrate.com/mortgages/improve-credit-before-mortgage/

https://pmc.ncbi.nlm.nih.gov/articles/PMC10783166/

https://themortgagereports.com/123422/fha-home-loans-single-mothers (2025-10-30)

https://www.fha.com/fha_article?id=518

https://www.va.gov/housing-assistance/home-loans/eligibility/ (2025-06-12)

https://www.veteransunited.com/education/va-loan-single-homebuyers/ (2025-11-17)

https://www.nerdwallet.com/mortgages/learn/conventional-loan-requirements-guidelines (2025-02-19)

https://themortgagereports.com/21489/how-to-buy-a-home-conventional-loan-mortgage-rates-guidelines

https://themortgagereports.com/33553/complete-guide-to-down-payment-assistance-in-the-usa (2025-02-28)

https://themortgagereports.com/84642/home-loans-for-single-parents-best-programs (2025-10-28)

https://money.usnews.com/loans/mortgages/articles/how-to-get-a-home-loan-when-youre-a-single-parent (2024-04-29)

https://www.milliman.com/en/insight/mortgage-market-and-housing-trends-q2-2025 (2025-10-30)