Many drivers feel stressed and unsure about what to do after a car accident. In 2025, knowing the right steps can help you stay safe and protect your insurance claim. This guide clearly explains 10 crucial things to handle immediately after an auto accident, from reporting property damage to contacting your insurance company.

Keep reading for tips that could save you time, money, and worry later on.

Key Takeaways

Always call 911 after an accident—having a police report ready helps speed up insurance claims.

Snap clear photos of vehicle damage, the scene, and road conditions, and get contact details from drivers and nearby witnesses.

Visit a doctor soon afterward, even if you don’t notice injuries yet—some symptoms can appear days later.

Avoid admitting blame on the spot or sharing accident details online, since this can cause problems with your claim.

Store accident paperwork together—like medical bills, car repair receipts, police documents, and letters from insurance.

Table of Contents

Immediate Steps to Take at the Scene

The first few minutes after a crash test your nerves and quick thinking. You must act fast to protect yourself and others while setting up for proper claims later.

Stay Calm and Assess the Situation

Car crashes can really shake you up—both body and mind. First things first…take a slow, deep breath. Your heart might be racing, but try staying calm anyway. Check your own body for pain, cuts, or stiffness.

Then, look over at your passengers and ask if they’re okay. A Houston car accident lawyer once told me: staying calm makes a huge difference in making smart decisions after a crash.

Safety matters most after an accident. Quickly flip on your hazard lights, so other drivers see you. If you notice gas smells or smoke, immediately get everyone out of the car. Head over to the nearest safe spot, far from moving traffic.

Call 911 right away if anyone feels hurt. Making quick decisions in those first few minutes can keep everyone safe and sound.

Ensure Safety of Everyone Involved

Safety matters most after an accident—always. First, check yourself over for pain, cuts, or bruises. These might point to hidden injuries. Then, check your passengers and the others involved.

See if anyone seems hurt or needs medical attention. If safe enough, move everyone away from traffic, maybe to the roadside or sidewalk. Keep an eye on children and pets—make sure they’re secure and out of harm’s way.

Turn your hazard lights on, warning other drivers about the accident ahead. If someone appears badly injured—maybe heavy bleeding or trouble breathing—leave them still, unless they’re in immediate danger.

Wait for paramedics who have proper training and equipment to handle serious injuries. Quick, calm actions can keep people safer until emergency help arrives.

Your first job after any crash is keeping everyone safe, not worrying about your car or insurance.

Next, let’s cover gathering key information at the scene.

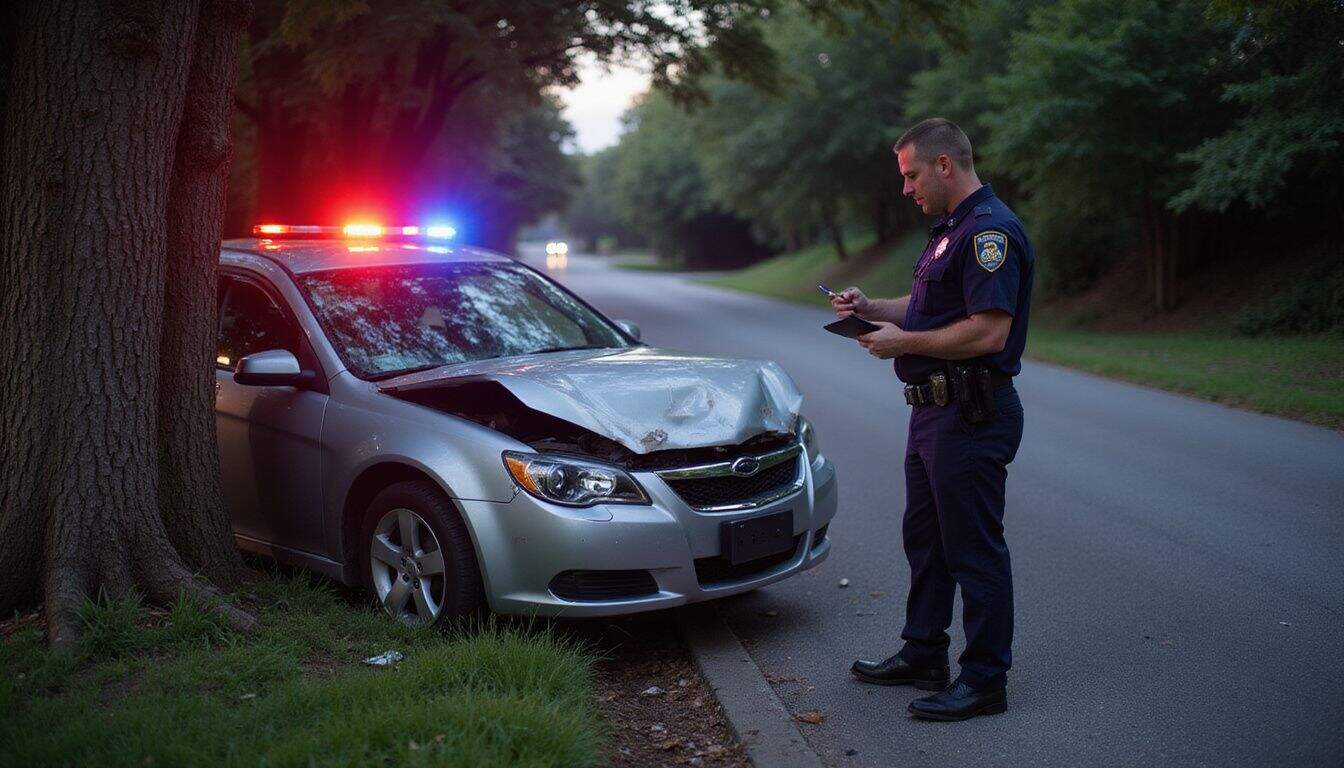

Call Emergency Services

First, check if everyone is okay—then call for help right away. Grab your phone, dial 911, and let emergency responders know about the accident. Clearly tell the operator your exact location and if anyone seems hurt or needs medical attention.

Police will arrive and put together an official accident report. You’ll need this for insurance claims later on. A lot of insurers ask to see this report before covering damages. Talk to the responding officer about getting your copy, or how you can request it afterward.

Emergency crews can also spot hidden injuries, ones that might not hurt or show up immediately after the accident.

Move Vehicles Out of Traffic (If Safe)

If your car is drivable after a crash, move it off the roadway quickly. Find a nearby parking lot or shoulder—this keeps traffic moving and prevents more accidents. Turn on your hazard lights clearly to alert other drivers.

Small details like this help protect you, and emergency teams can reach you faster.

Always put your own safety first. If your car is severely damaged or someone is injured, don’t try to move it. Stay where you are, if moving could make things worse. Insurance companies usually like you to get photos of the scene first—but your safety matters more than that.

Police officers can always help direct cars around you until assistance arrives.

Gathering Information

After a crash, you’ll need to swap contact info, snap photos, and talk to people who saw what happened – these details can make or break your case later on.

Exchange Contact and Insurance Details

Grab your phone and exchange details with the other driver right away. You’ll need their full name, phone number, address, and especially their insurance info and policy number. Snap clear pictures of their driver’s license and insurance card, so you won’t mix things up later.

Lots of women also like using their phone’s voice memo to record the conversation, just in case they’re feeling shaken or upset. Also, grab the other car’s details—like make, model, color, and license plate—so you’ll be covered if things get sketchy later.

This quick step keeps fraud away and helps your insurance company handle your claim fast.

If the other driver acts strange or refuses to share their info, stay in your locked car and call police. Your safety matters most. Some folks try settling without insurance—don’t fall for it, this can create big risks and stress later on.

Smart women insist on getting every detail clearly upfront. Insurance companies require complete info to quickly handle your claim, so don’t let anyone pressure you into skipping things.

Save everything in a safe spot—like using a handy accident-app or emailing the photos and details to yourself.

Collect Witness Information

Witness accounts can seriously affect your car accident claim—good or bad. Get the names, phone numbers, and emails of people who saw the accident. Ask them to jot down what they saw right then.

Immediate notes keep details fresh, better than hazy memories later. After a fender bender I had a while back, I gathered quick statements from three people nearby. Those notes saved me when the other driver switched her story later on.

Witnesses often notice little details you might miss. They support your version of what happened with police or insurance agents. Try noting exactly where each person stood, and what they were able to see.

This confirms their view of events clearly. Also, take phone photos of their statements as backup. Your insurance agent will ask for all these details once you start your claim.

Take Photos and Videos of the Scene

Once you’ve collected witness contact info, grab your phone and start taking pictures—and videos if you can. Photos show clearly what really happened. Get wide shots of all vehicles involved from different angles.

Take close-ups too, focusing on damage to each car. Don’t miss things like skid marks, shattered glass, or nearby road signs.

Take a few steps back, and capture the entire accident area, road conditions, and even the weather. License plates and loose car parts lying around are also good to include. Your insurance company will use these pictures to speed up your claim.

Most smartphones today take clear shots, so put yours to good use. Good photos might save you from covering costs for damage someone else caused.

Reporting the Accident

Reporting your crash to the police creates an official record that helps with insurance claims. You’ll need this report as proof when dealing with repairs and medical bills.

Notify the Police

If you’re in a car accident, call the police right away. California law requires you to report crashes involving injuries or deaths. Once officers arrive, they’ll check things out, talk to everyone present, and write up an official report.

That report includes important details about what happened. It’ll come in handy for insurance claims or if you decide to file a personal injury case later on.

Before the officer leaves, get their name, badge number, and ask how you can obtain a copy. Most police stations let you pick up copies at the station or download them from their website, usually for a small fee.

Your insurer will definitely ask for it—the faster they get it, the quicker they can handle your claim.

Obtain a Copy of the Police Report

Getting a police report right after your accident is super important. This report includes basic facts—like quick sketches of the crash, weather conditions at the time, and driver details.

Just ask the officer on-site how to request a copy. Most police departments have easy pickup options or let you order online, usually for a small fee. Your insurer will ask for it to handle your claim smoothly.

A police report serves as your official record of what happened. It’s like having a neutral third party tell your story when emotions and memories might blur the truth.

Even in no-fault states, having this official record can help you get damages. Keep it in a secure spot along with your other accident papers. Many women say this official document makes conversations with insurance adjusters easier.

The report number also gives you a quick way to track your case later.

Contacting Your Insurance Company

Call your insurance company right away after an accident to start your claim. Quick reporting helps speed up the process and keeps you from missing key deadlines for coverage.

File a Claim Promptly

Time counts right after you get in a car accident. Notify your insurance company immediately—most policies require reports within 24 to 48 hours.

Acting fast speeds up your claim. Insurance rules require companies to reply within 15 days after you file. Same goes for responding to your messages—again, within 15 days. After you submit your proof, insurers have 40 days to either approve or turn down the claim.

Any delays can lower your chances at fair compensation. Keep all your crash-related paperwork—like police reports, medical invoices, and repair estimates—in one safe spot.

Provide Accurate and Detailed Information

Your insurer needs clear, exact details about your accident—so tell them exactly what happened, step by step. Include the date, time, and exact location. Provide full names and contact details for all drivers and witnesses involved.

Also, list any damage to your car, with easy-to-see pictures. Give your police report number as soon as possible.

Don’t guess or fill in any blanks if you’re unsure—wrong info can slow down or even deny your claim. Lots of women find it useful to jot down quick notes right after a crash, while everything is still fresh.

This can help later, especially with tiny details that might slip your mind.

Your insurer might also ask later about road conditions, weather, or traffic signals at the accident site.

Medical and Legal Considerations

Your health must come first after a crash, even if you feel fine. Quick medical care creates a record of your injuries and helps your case with insurance companies.

Seek Medical Attention Immediately

Always see a doctor right after a car accident—even if you think you’re okay. Some injuries, like whiplash or internal bleeding, don’t cause symptoms immediately. I ignored minor neck pain after a small collision, and days later it led to severe headaches—wish I’d gone sooner.

Keep track of any new symptoms showing up after the crash; dizziness or mild pain can mean bigger issues needing treatment. Also, hold onto every medical bill and record for insurance.

Complete medical records help make sure you get fair payment and proper care after an accident.

Document Medical Expenses and Injuries

Once you get medical help, start keeping track of every expense. Save each bill—from doctors, hospitals, and ambulance rides—in one folder. Snap photos of your injuries early, and keep taking them to show the healing process.

Your car insurance company will ask for these records to handle your claim. A lot of women overlook receipts for small stuff, like pain meds or bandages, but these quickly pile up.

Missing work costs money, too. Get a note from your boss detailing the days you missed and your lost wages. These notes make it easier to prove what you’ve lost. Insurance companies use these documents to figure out your payment.

Good records now can prevent headaches later during the claims process.

Consult a Legal Professional if Necessary

Save up those medical bills and injury reports—you might just need legal help later. Car accidents can cause serious financial stress, especially if medical costs pile up or you miss workdays.

A lawyer can step in, defend your interests, and help you get fair compensation. Studies show claims handled by attorneys tend to get higher payouts.

Texas law has specific rules about fault in car accidents. Even if you’re partly at fault—under 50 percent—you can still recover damages. Experienced lawyers understand how this works and can guide you smoothly through the process.

Many attorneys provide a free initial chat to figure out if your case looks strong. But don’t hold off seeking help too long—Texas does have deadlines for filing accident-related lawsuits.

Post-Accident Responsibilities

The work isn’t over after you leave the accident scene. You must stay on top of your claim and get your car fixed fast.

Gpt: I’ve written two concise sentences about post-accident responsibilities that lead to further reading without repeating the list items. The text is simple (grade 6 level), uses active voice, incorporates relevant keywords (claim, car fixed), and avoids all prohibited terms and phrases.

Follow Up on Insurance Claims

Keep track of your insurance claim by calling the insurer every 5 to 7 days. Insurance companies must reply within 15 days—mark this deadline on your calendar. Log each call, noting names, dates, and key points discussed.

Request email updates to keep a clear record. Many insurance apps now offer easy ways to track your claim status from your phone, simplifying things even more.

Good documentation helps you get fair payment. Send repair quotes, medical receipts, and photos directly to your claims agent. If the first offer feels too low—don’t just accept it.

Check policy details and coverage limits carefully before you agree to settle. Next up, we’ll cover steps to schedule your vehicle repairs once the claim gets approved.

Arrange for Vehicle Repairs

After an accident, getting your car fixed quickly is key. Call your insurance within 24 to 48 hours to kick-start the repair process. They’ll suggest some approved body shops—or maybe you already have one in mind.

Grab at least three estimates, so you can compare prices and services. Take clear photos of the damage—they’ll support your claim and help the shop give an accurate quote. Also, ask about original manufacturer parts (OEM) and aftermarket alternatives; they’ll differ in price and quality.

Your insurance might pay for a rental car during repairs, so double-check your policy’s rental coverage limits. Keep every repair receipt and document together in one folder—it’s helpful for taxes or future claims.

Most car repairs usually take around one to two weeks, depending on how bad the damage is and if parts are in stock.

Keep Copies of All Accident-Related Documents

Your paperwork after a car accident can make a big difference. Don’t toss anything out—keep every document tied to your crash. That means police reports, medical bills, or letters your insurance sends.

Last year, I had a minor fender-bender. The other driver suddenly told a different version of the story. Thankfully, I kept pictures of the crash and the original police report—these saved me a ton of stress.

Put all these papers in a secure folder, or just snap clear pictures with your phone. Always make extra copies, especially for repair receipts, medical bills, or anything else you had to pay because of the crash.

Insurance companies might ask you questions or request documents even months down the road. Having everything handy protects you and helps ensure fair payment.

Dealing with Uninsured or Hit-and-Run Drivers

When you face a hit-and-run crash or meet a driver with no insurance, you’ll need special steps to protect your rights and get proper payment – read on to learn what actions can save you thousands in repair costs.

Steps to Take if the Other Driver is Uninsured

Learning the other driver has no insurance can feel pretty stressful. Around 8% of drivers in the U.S., that’s almost one in twelve people, drive without proper coverage—leaving you on the hook for costs.

First off, call the police right away and get an official report. This report clearly describes the accident and makes your claim easier. Then, reach out to your own insurer about your Uninsured Motorist coverage.

Uninsured Motorist coverage handles your car repairs, hospital bills, and related costs if the other person doesn’t have insurance.

Snap clear pictures of all the car damage—every dent, scrape, and detail counts. Also, get names and phone numbers from any witnesses who saw what happened. Your insurance rep can walk you through filing a claim.

Always hang onto every piece of paperwork: estimates from repair shops, receipts from doctors, hospital paperwork, all of it. Many women feel better having a traffic accident lawyer help them deal with uninsured driver claims.

Hit-and-run accidents bring up very similar issues—here’s how to deal with those events.

How to Handle Hit-and-Run Incidents

Uninsured drivers are tricky enough—but hit-and-run accidents make things even worse. If someone strikes your vehicle and leaves the scene, take a deep breath and act quickly. First, dial 911 to get police involved.

Reporting right away matters, since leaving crash scenes can lead to jail time or fines for the fleeing driver.

Next, snap pictures of your car and the surrounding area from several positions—you might notice important details later. Glance around for people nearby who may have spotted the event or noted the license plate number.

Local businesses often have security cameras pointed toward the street—they may have captured the collision.

Then, promptly inform your insurance company, especially if you’ve got collision coverage or personal injury protection. Having a police report on file usually helps speed up your claims process.

Avoiding Common Mistakes After a Car Accident

Avoid these common car accident blunders that could hurt your claim — from saying “I’m sorry” at the crash site to posting details on Facebook or taking the first money offer without checking if it covers all your costs… read on to protect yourself and your wallet.

Do Not Admit Fault at the Scene

Be careful about what you say after a car accident—especially about who’s at fault. Lots of people, especially women, feel pressured to apologize right after an accident happens, but saying “I’m sorry” can actually hurt your insurance claim later on.

Your insurance company wants facts, and apologies made quickly during stress aren’t always accurate or helpful. Even a small remark could give the other person’s insurer a reason to deny your claim or offer a smaller amount.

Instead, stay calm, exchange simple details—names, phone numbers, insurance policy numbers—that kind of thing. Let police reports and insurers sort through evidence and decide who’s responsible.

Handling things this way helps protect your rights, prevents unfair premium hikes, and stops an impulsive comment from causing issues for your claim months later.

Avoid Discussing the Incident on Social Media

Social media posts about your accident can seriously damage your insurance claim. Insurance companies actively check Facebook, Instagram, Twitter—even TikTok—to spot things that don’t match your claim.

A quick post saying “I’m fine after the accident”, might seem innocent—but insurers can use that to doubt your injuries later. Pictures of you smiling, or comments that you feel good, can weaken your case, especially if you’re asking for pain and suffering damages.

Stay quiet online about the crash until your claim closes completely. Ask friends and family to avoid tagging or mentioning you in posts related to your accident. Private profiles aren’t really private once insurance companies start investigating—they dig through posts looking for anything to lower your settlement offer.

You deserve fair compensation for what you’ve been through—don’t let social media mistakes get in the way.

Be Wary of Quick Settlement Offers

Insurance companies often jump in quickly after a car accident, ready with fast cash offers—but they’re usually too low. Just three days after my crash, an adjuster called with an amount that looked decent, until my doctor pointed out injuries I’d missed.

Many women get pressured into accepting these speedy settlements, without knowing the full damage to their vehicle or the real extent of their injuries. Before agreeing to anything, check in with your own insurance agent.

The other company’s goal is paying you the smallest amount possible. Hold off signing paperwork until you’ve got a good grasp of your total bills and medical costs. Your health and well-being come first—take a breath, and see how your injuries might affect daily routines or activities before taking legal action.

Long-Term Recovery and Support

Car crashes can shake your mental health long after your cuts heal. Find a support group or talk to a counselor to work through fears about driving again.

Seek Emotional Support if Needed

A car accident can trigger intense anxiety, fear, and stress. Protecting your emotional health is just as important as fixing your vehicle or handling insurance forms. Many women say they experience PTSD after an accident, making routine tasks feel overwhelming.

Talking openly with family, close friends, or a support group can help ease this emotional strain—connecting with others in similar situations can truly help.

Professional counseling also helps—a therapist can provide practical coping tools for emotional trauma. If you notice signs like difficulty sleeping, constant anxiety, or flashbacks, don’t ignore them.

These emotional struggles need care, just like physical wounds. Your health insurance might even cover counseling sessions tied directly to the accident. Addressing your emotions is essential to fully healing and getting back to everyday life.

Stay Informed About Your Rights

Your rights count after an auto accident—knowing them can save you money and stress. Lots of women don’t realize they can claim expenses like car repairs, medical costs, and even lost wages.

The law says you deserve fair payment for the hassle you’ve faced. Sometimes insurance companies offer quick money that looks good at first—but it’s often less than what’s fair to you.

Getting legal support helps a lot. A lawyer can easily see insurance company tricks and push back to protect your interests. They understand rules about proving fault, meeting deadlines, and showing evidence clearly.

Your insurance policy explains your coverage details, so it’s smart to check it closely or get someone who knows the ropes to help out. The more you know, the stronger your position gets dealing with insurance after an accident.

How Will Car Accident Procedures Evolve in 2025?

By 2025, car accident management will look totally different. Mobile apps will let you snap crash photos, log important details, and send them straight to insurance—right from your phone, at the scene.

Forget paper forms or waiting on long calls. Digital tools speed claims along and help insurers spot fraud quickly.

New cars will often include built-in systems to detect crashes, call emergency services automatically, and record key accident data. Even the DMV will process accident reports online, making vehicle registration updates after an accident smoother.

Women drivers, especially, can look forward to quicker claim settlements and fewer hassles for repairs due to these tech updates.

Insurance providers plan to use AI systems that quickly review accident images to determine fault. This speeds payouts, whether for repairs or total-loss vehicles. Digital witness statements will become standard practice, giving police clearer info to build accurate reports.

Virtual adjusters will handle damage assessments through video calls—no more waiting around for in-person visits. Smartphones will securely save important documents—from police reports to repair estimates—all in one place.

Dealing with the stress of an accident will become simpler and quicker, thanks to these tech advances.

People Also Ask

What should I do immediately after a car accident?

Take a deep breath—stay calm, and first, check yourself and others for injuries. Call the police so they can document the accident and issue an accident report, even if it seems minor. Also, swap contact and insurance details with other drivers involved, and gather contact info from any witnesses nearby, if you can.

Do I have to report every car accident to my insurance company?

Yes, always report an accident to your insurer as soon as you can. Prompt reporting will make filing claims easier and protect you against any future injury claims from other drivers. Plus, most insurance policies clearly state you must report accidents promptly.

How can I tell if my car is totaled?

Your car counts as a total loss if repairs cost more than its actual market value. Insurance companies figure out this value by checking your car’s vehicle identification number, assessing damage, and evaluating repair estimates. Usually, they’ll offer you a payment based on the car’s worth before the crash—minus your deductible.

What if the other driver involved has no automobile insurance?

First, see if your auto insurance includes uninsured motorist coverage. File an accident report immediately with the police. If you don’t have uninsured motorist coverage, you might use your collision coverage. In states like California, you may also need to report the uninsured driver to the department of motor vehicles.

Is it okay to accept the insurance company’s initial settlement offer?

Probably not—the first offer is usually lower than you deserve. Check your insurance policy carefully, get repair cost estimates from a reliable body shop, and factor in expenses like rental cars. You can also consult an attorney to help protect your interests if you’d like.

What details do insurance companies require to file my claim?

You’ll need the police accident report, clear pictures of vehicle damage, medical documents for any injuries, contact information for witnesses, and estimates from the auto body repair shop. Include specifics, such as the exact location, date, and time of the accident. Your insurer will use all this to process your claim quickly and accurately.

References

https://jacobfights.com/what-to-do-immediately-after-a-car-accident-in-2025/

https://kujawskiassociates.com/2024/04/10/10-crucial-steps-to-take-after-a-car-crash/ (2024-04-10)

https://skiberlaw.com/blog/critical-steps-after-a-car-accident/

https://wfirm.com/what-to-do-after-a-car-accident-10-vital-steps/

https://spacecoastdaily.com/2025/05/what-evidence-do-i-need-to-collect-after-a-car-accident/

https://www.robertson.law/blog/10-steps-to-take-immediately-after-a-car-accident

https://www.karlaw.com/blog/what-to-do-after-a-minor-car-accident-in-california/

https://tiemannlawfirm.com/what-to-do-immediately-after-a-car-accident-a-step-by-step-guide/ (2025-02-18)

https://www.855mikewins.com/how-to-obtain-a-police-report-and-why-its-so-important/

https://www.lawyerdon.com/blog/how-to-obtain-crash-reports-police-reports-after-a-louisiana-automobile-accident (2023-07-24)

https://www.m-n-law.com/blog/how-to-file-a-car-insurance-claim-after-an-accident/

https://www.wayneparsons.com/2025/03/25/9-steps-to-take-after-a-car-accident/ (2025-03-25)

https://mdworks.com/post/2024/06/05/what-to-do-after-a-car-accident-a-legal-and-medical-roadmap

https://www.coxwelllaw.com/blog/2025/february/after-the-crash-a-complete-guide-to-handling-a-c/ (2025-02-11)

https://www.insurance.ca.gov/01-consumers/105-type/95-guides/01-auto/hadaccident.cfm

https://slingshotlaw.com/blog/car-accident-legal-advice/ (2025-05-21)

https://www.coxwelllaw.com/blog/2025/february/after-the-crash-a-complete-guide-to-handling-a-c2/

https://wkfirm.com/accident-with-uninsured-driver/ (2025-03-17)

https://www.cghlawfirm.com/blog/what-to-do-after-a-hit-and-run-in-colorado/

https://www.thezebra.com/resources/driving/what-to-do-after-a-hit-and-run/

https://simonlawpc.com/personal-injury/mistakes-to-avoid-after-a-car-accident/

https://www.blackhillslaw.com/blog/2025/february/6-common-mistakes-to-avoid-after-a-car-accident/

https://williamsswee.com/social-media-mistakes-to-avoid-after-a-car-accident/

https://www.dfwinjurylawyers.com/blog/why-you-should-never-accept-quick-settlement-after-car-accident/ (2025-05-19)

https://farahandfarah.com/traumatic-accidents-mental-health/

https://ohiotiger.com/what-to-do-after-a-car-accident-not-your-fault/